Food inflation and higher input costs for farms and food processors: Is there a link?

Wednesday, November 16, 2022

Reference: FCC

This is the first of two posts looking at agri-food price transmission, or the effect of farmers’ input prices on the prices that food processors receive for pork and dairy products.

This is the first of two posts looking at agri-food price transmission, or the effect of farmers’ input prices on the prices that food processors receive for pork and dairy products.In an environment of high and volatile commodity prices, it’s fair to ask how much of an increase in the price of making bacon can be traced back to the cost of fertilizer used to grow the grains used to feed the pigs that make the bacon. In this post, we look at one important link in the supply chain – that of ag producer-to-food processor – to understand the inflationary pressures on price transmission from the farm gate to the manufacturing gate.

Inflation a global phenomenon

Food prices, and how much higher they are now, is a global story. The September Consumer Price Index (CPI) shows that food experienced a 10.3% year-over-year (YoY) increase in 2022, in no small part due to COVID-19’s lingering influence on demand and supply. As the pandemic has worn on, pent-up demand has raised commodity prices sky-high in some cases, with supplies made worse by supply-side shocks such as severe weather and geopolitical turmoil.At the farm level, input costs have ballooned since 2019. Obvious questions relate to the transmissibility of costs from the farm gate through the supply chain to the processors who turn the commodity into food. How much of those farm-level costs are passed on? Are they passed on quickly, i.e., when they’re incurred, or is there a lag? What additional cost increases are applied at the manufacturing level, and how have those trended?

Price transmission refers to the effect of prices in one market on the prices of another.

This analysis relies on data from three Statistics Canada datasets.

- The Farm Product Price Index (FPPI) measures the prices Canadian farmers receive from the sale of agricultural products.

- The Raw Materials Price Index (RMPI) measures price changes for raw materials purchased for further processing by manufacturers operating in Canada.

- The Industrial Product Price Index (IPPI) measures price changes for products sold by manufacturers operating in Canada.

A sharp increase in ag’s costs of production since 2019

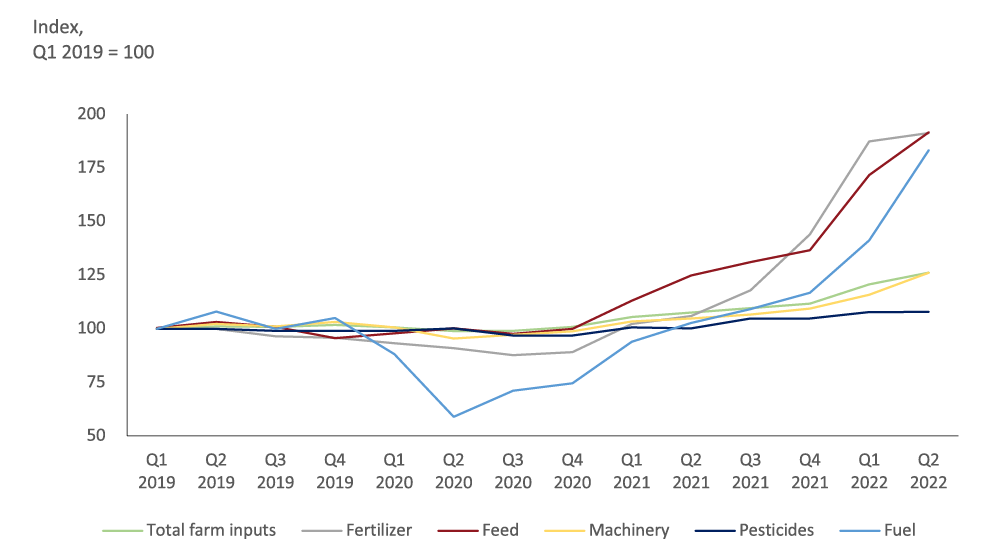

Figure 1 shows the steep cost increase at the overall farm level between 2019 and 2022. Although all major categories of farm input costs have become more expensive over the last 3.5 years, feed, fuel and fertilizer costs have exploded.Figure 1: Feed, fuel and fertilizers top inflation index

Source: CANSIM Farm Input Price Index - Table 18-10-0258

As of June 2022, fuel costs had increased more than 80% since the first quarter of 2019, while average fertilizer and feed costs had come very close to doubling, with some fertilizer types more than doubled. While they didn’t reach the same highs, machinery and pesticide costs have also risen, leading to overall farm input growth of 25%. And as of September 2022, the cost of farm labour (not shown) had increased almost 13% from January 2019 levels.

At the processing level, the prices manufacturers pay for raw materials have gone up, along with other costs. According to Industry Canada Financial Performance data, raw material purchases and sub-contracts in dairy processing (for businesses with revenues <$20M) accounted for nearly 60% of revenues in 2020. Total wages (salaried and hourly) have increased by 10.6%, on average, annually between 2019 and 2022.

In this post, we look at the extent to which the inflationary pressures of farm inputs (grain prices) are transmitted through the manufacturing used to turn unprocessed milk into dairy products and lean hogs into pork products.

Price transmission in a supply-managed supply chain

In 2022, processors are paying dairy producers more for unprocessed milk components than in early 2019, and much of that is captured in the transmission of the sharp increase in feed prices. Growth in the Farm Product Price Index (FPPI) prices paid for grain is highly correlated (94%) with movement in the FPPI Unprocessed Milk Index, so it’s not surprising that another hike in milk prices has been set for February 2023, with expenses continuing to creep up.Figure 2 shows the low volatility of grain prices throughout 2019 and most of 2020, then the tremendous price movement in 2021, which continued in the first half of 2022.

Figure 2: Inflation in dairy feed costs shows up in unprocessed milk prices

Source: Statistics Canada. Table 32-10-0098-01 Farm product price index (FPPI), monthly

However, the higher grain prices shouldn’t generate the same inflationary measures for raw milk at the farm or processing levels. Their impact depends on their proportion of total costs: in dairy, feed costs represent roughly one-quarter of total costs (unindexed). Because inputs other than grains are used in raw milk production at the farm level (as illustrated in Figure 1), each of which is subject to its inflationary pressures, the steepest grain price inflation was only mimicked with an inflationary trend in milk prices.

Nonetheless, the last 12 months have been difficult because, in addition to rising grain prices, other costs of production have also risen. According to the Canadian Dairy Commission and indexed to June 2022, dairy’s feed rationing has climbed 22% since 2021, fuel and oil by 66%, and fertilizer and herbicides by 35%. Machinery and equipment repairs and other miscellaneous costs have also increased... Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.