Buy or lease? A guide to choosing farm equipment

Monday, June 19, 2023

Reference: BDO Canada - Agriculture

Many modern farms face the challenges of consolidation, expansion, labour and supply chain issues, equipment advancements, and rising costs. As a result, it has become crucial for farmers to adopt an effective machinery and equipment strategy. In this article, BDO agricultural accountants crunch the numbers to answer a frequently asked question: is it better to lease or buy farm equipment?

Many modern farms face the challenges of consolidation, expansion, labour and supply chain issues, equipment advancements, and rising costs. As a result, it has become crucial for farmers to adopt an effective machinery and equipment strategy. In this article, BDO agricultural accountants crunch the numbers to answer a frequently asked question: is it better to lease or buy farm equipment?Both options have their advantages and disadvantages, and the decision you make will depend on your specific needs and financial situation. Consider the following pros and cons of buying vs. leasing:

Buying farm equipment

One of the biggest advantages of buying farm equipment is that you own it outright and will build more equity than leasing. Additionally, owning your equipment gives you greater flexibility in terms of when and how you use it, as you are not bound by any lease agreements. You can modify machinery to suit your specific needs and sell it when you are ready to upgrade. However, you'll need to take into consideration the cost of maintenance and repairs—and potential downtime as a result.Leasing farm equipment

Leasing farm equipment has many benefits as well, it's a good option if you want to upgrade your equipment on a regular basis. Another benefit of leasing is the warranty and technician support, reducing risk during critical times. For some, this could be seen as drawback. Since you aren't the owner, repairs and modifications will likely need to be done by the dealership.Tax and financial considerations of buying vs. leasing

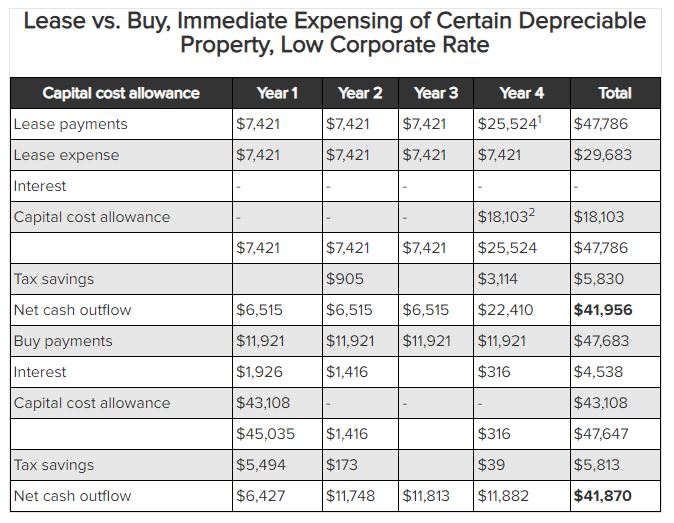

To help figure out what's better from a tax perspective—buying or leasing—let's use a real example of modern farm equipment, taken from an actual manufacturer's website.The table below shows the net cash flows under different capital cost allowance rules (assuming class 10 with a 30% depreciation rate) and corporate tax rates.

Purchase price: $43,108.37

Lease payment: $618.40

Financing payment: $993.40

Tax rate: 12.20%

Residual value: $18,103.05

Finance rate: 4.99%

Lease rate: 5.49%

Lease vs. Buy, Immediate Expensing of Certain Depreciable Property, Low Corporate Rate Capital cost allowance

¹ Includes the buyout of the residual amount at the end

² Assumes the immediate expensing rules are still in place, however current rules state that the property must be available for use before 2025

After analyzing the numbers, it's evident that there is no clear winner between leasing and buying. Both options yield comparable total cash flows over the four year-period. However, the significant difference lies in the timing of the cash flows and the risk mitigating factors listed above.

Using various tax rates and capital cost allowance rules in this analysis, also resulted in net cash flows of buying within a few hundred dollars of the lease. With the current tax rules that are in place, taxation should be a secondary consideration when making a purchase decision. The cash flows and business reasons for leasing versus buying are more critical.

Additional tax considerations

For HST purposes you may be able to purchase a piece of farm equipment “zero-rated,” (meaning an HST rate of zero), however be aware that HST will be charged on lease payments.It's important to consider the timing of a purchase or a lease, especially the time of year you are planning this transaction. If you purchase or lease a piece of equipment and it is available for use in the last month of your fiscal year, you can calculate a full year's capital cost allowance on that piece of equipment. However, if you lease it, you will only have one lease payment to expense in the year.

When it comes time to sell the equipment, there will be different tax implications to consider. When you trade in leased equipment, it may result in capital gains tax versus recaptured capital cost allowance upon the sale of purchased equipment.

Helping you choose the right option

The decision to lease or buy farm equipment is a big one, and it's important to consider all the options. BDO's trusted agriculture accountants can help you make the right decision based on your farm's specific needs and financial situation.Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.