2023 economic trends: Dairy products

Monday, July 17, 2023

Reference: FCC

This information is shared from the 2023 FCC Food and Beverage Report – highlighting the opportunities and challenges for Canadian food manufacturers by industry. To get the bigger picture – read the full report.

This information is shared from the 2023 FCC Food and Beverage Report – highlighting the opportunities and challenges for Canadian food manufacturers by industry. To get the bigger picture – read the full report.Value-added dairy products driving growth

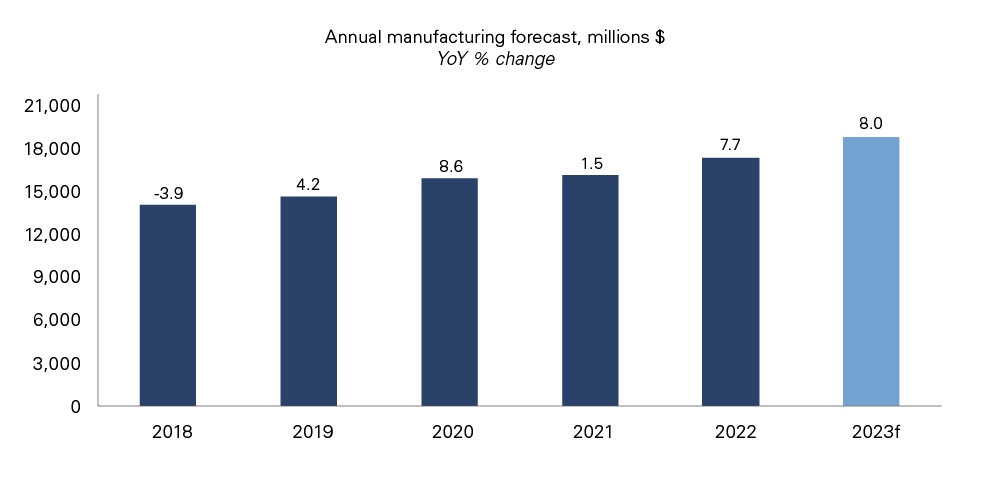

FCC Economics projects dairy product industry sales to increase 8.0% in 2023 (Figure D.1).Figure D.1: Dairy product sales expected to increase 8% in 2023

Sources: FCC Economics, Statistics Canada, Barchart, Moody’s Analytics

Sales growth is expected to be the strongest in the first half of the year, largely the result of higher manufacturing prices amid inelastic demand. Retail demand for value-added dairy products like cheese, butter and enhanced milk remains strong, and restaurant demand is growing. We expect volume growth to be in the low-single digits overall, dragged down by the low growth of fluid milk volumes.

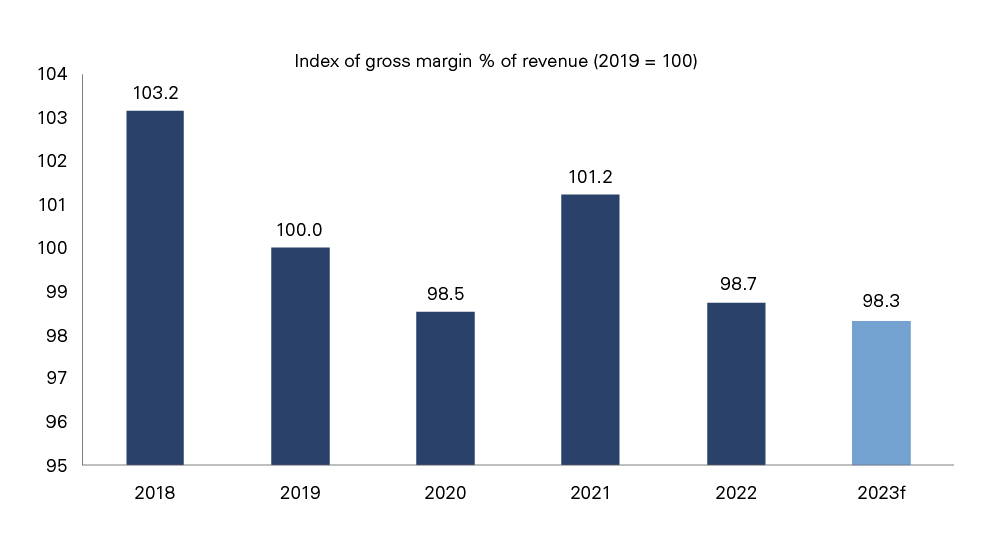

Gross margins are projected to decline slightly in 2023 (Figure D.2). Margins on high-volume dairy products like cheese and butter are expected to be strong, and if those volumes increase, it could lead to higher industry margins. Manufacturers have been able to pass through higher butter costs to consumers, given that prices of substitutes like margarine have also recorded strong inflation. Retail butter prices rose 8.6% in 2022 compared to margarine inflation of 29.9%.

Figure D.2: Dairy manufacturing margins fell slightly in 2022

Sources: FCC Economics, Statistics Canada

How we got here: A double-dip milk cost increase in 2022

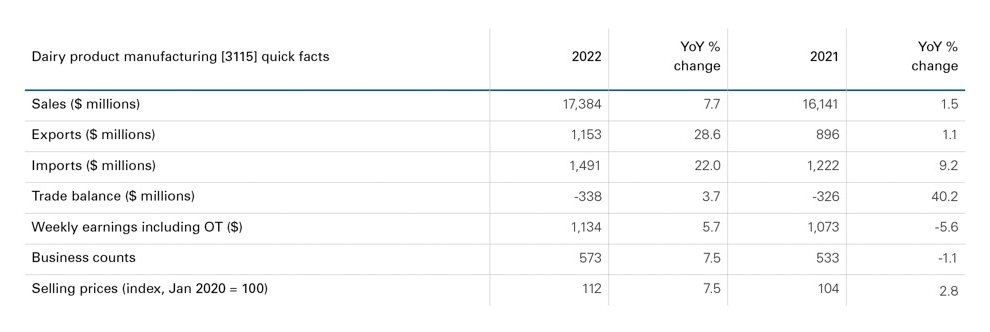

Industry sales grew just under 8% in 2022 YoY (Table D.1), with higher prices leading the growth, stemming from two increases in butter support prices mandated by the Canadian Dairy Commission. Demand is strong for products like creamers, products for lactose intolerant consumers, infant formula, ice cream and cheese; these will likely drive growth in 2023. Infant formula was in the top 5% of best-performing grocery volume growth categories in 2022.Canadian retail dairy prices rose 8.6% in 2022, compared to 12.0% in the U.S. and compared to the United National global estimation of 19.6%. Consumer prices rose faster than manufacturer selling prices for the fourth consecutive year, as retailers increased prices faster than the products’ cost had risen. We expect retail dairy inflation to moderate in 2023 but remain above the five-year average of 1.3%.

Table D.1: Higher prices and foodservice volumes drove sales growth in 2022

Source: Statistics Canada

While sales grew in 2022, many items reported volume declines, according to data from Nielsen IQ. Grocery fluid milk volumes fell 3% in 2022 but were offset by higher value-added volumes in foodservice. Dairy alternatives like oat milk also had volumes fall 3%. The price of oat is down over 40% YoY which could make oat-made dairy alternatives more competitively priced than dairy. Although alternative dairy products are expanding and have taken up more shelf space in stores, traditional milk is holding its own with innovative products like ultrafiltered, lactose-free and high-protein varieties. These products offer the dairy industry a growth opportunity.

Gross margin as a percent of sales decreased modestly in 2022 on higher labour and raw fluid milk costs. The labour market was difficult in 2022, but sector-wide efficiencies allowed gross output per employee to rise over 14% YoY. Wages grew by over 5%, below the food manufacturing industry average. The total number of dairy manufacturers grew by 40 YoY, with increases across all business sizes.

Bottom line

- Monitoring trends in consumption preferences will be key to success.

- Evolving demand from foodservice channels for value-add dairy products shows potential.

- Keep an eye on growth in alternative beverages and consider strategies to maintain market share.

- Increasing input costs and inflation will pressure gross margins in the year ahead.

Read More

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.