2022 Cattle and hogs outlook update: Spectre of demand destruction looms over livestock markets

Wednesday, October 26, 2022

Reference: FCC

This is the last quarterly update to our 2022 Outlook for the cattle and hog sectors published in February. Over the last two weeks, we’ve updated our Outlooks for dairy and grains and oilseeds.

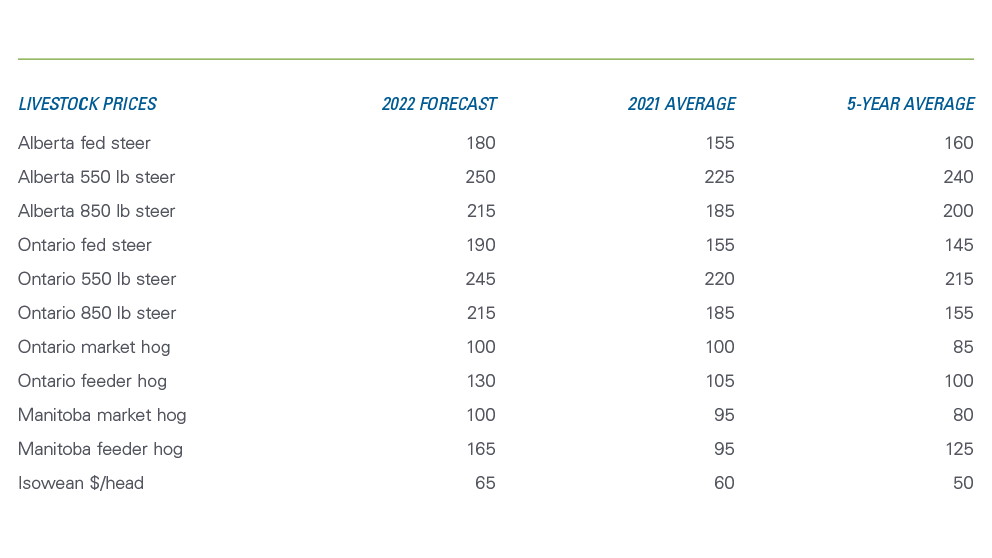

This is the last quarterly update to our 2022 Outlook for the cattle and hog sectors published in February. Over the last two weeks, we’ve updated our Outlooks for dairy and grains and oilseeds.Continued strength in cattle prices has pushed the average 2022 price for cattle in the East and West beyond our August outlook forecast. And while annual average hog prices are now forecast slightly under that last one, they’ll remain higher year-over-year (YoY) and well above their previous 5-year averages (Table 1).

Table 1: Cattle prices ($/cwt) continue to rise as hog prices fade slightly

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Such strong prices will keep cow-calf profitability above breakeven throughout the remainder of 2022, while strength in feed costs and current packer “congestion” will continue to pressure feedlot profitability. The year’s margins are expected to be better than their respective 5-year averages for cow-calf operations and considerably weaker for feedlots, which should finally find some relief in 2023.

Hog margins are forecast to be mixed throughout the outlook period. Isowean margins in the east and west will remain below their 5-year averages this year, while farrow-to-finish operations’ margins will best their 5-year averages. Eastern farrow-to-finishers won’t quite reach the positive margins of their previous 5-year average, but they’ll be well above breakeven.

However, globalized inflation has raised headwinds to Canada’s livestock sectors with high feed costs and the possibly reduced global demand for meat. That’s influencing the current basis in Western Canadian cattle markets, as U.S. packers face limited supply from a shrinking herd and early drought-induced marketings.

At the same time, according to Anne Wasko, Canadian packers can’t get current. In the third quarter, slaughter numbers are down, and plants aren’t working to capacity as packers face challenges to move the beef along. Not even the highly supportive CAD can offset the influence of the supply congestion in Canada. Production is further delayed with feed costs rising faster than the loonie is falling and limited trucking available to move cattle after auctions.

In the U.S., a smaller sow herd will mean fewer farrows and a smaller swine herd overall (a 1.2% YoY fall). The USDA expects a smaller slaughter in 2022 and a second year of retracted growth in YoY pork production. Global demand for U.S. pork is expected to drop 8% YoY, and if pork supplies don’t get used, those currently strong prices may fall.

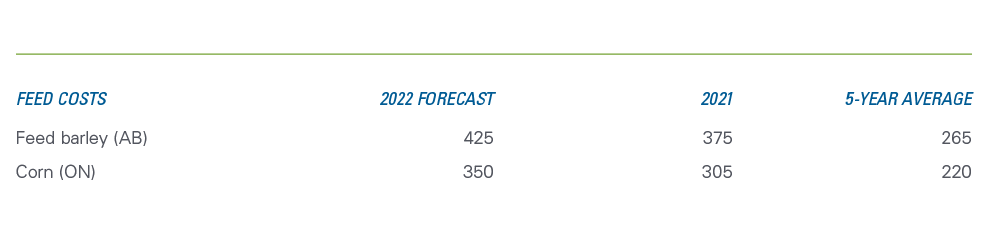

Feed costs on the rise

After a brief reprieve, feed costs are once again climbing. Our forecast for average feed barley in 2022, revised higher than our August projections, is now up 11.8% YoY and up 37.7% over the 5-year average (Table 2). Corn is also higher than in August, up 12.9% YoY and 37.1% over the 5-year average.Table 2: Feed costs ($/tonne) still a drain on livestock profitability

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

On the eve of demand destruction

In its October outlook, the International Monetary Fund (IMF) downsized its expected global economic growth from 6.0% in 2021 to 3.2% YoY (falling to 2.7% in 2023) and projected inflation for 2022 at 8.8% (falling to 6.5% in 2023 and to 4.1% by 2024). Under such recessionary pressures, consumption of red meat is likely to decline.China steps back

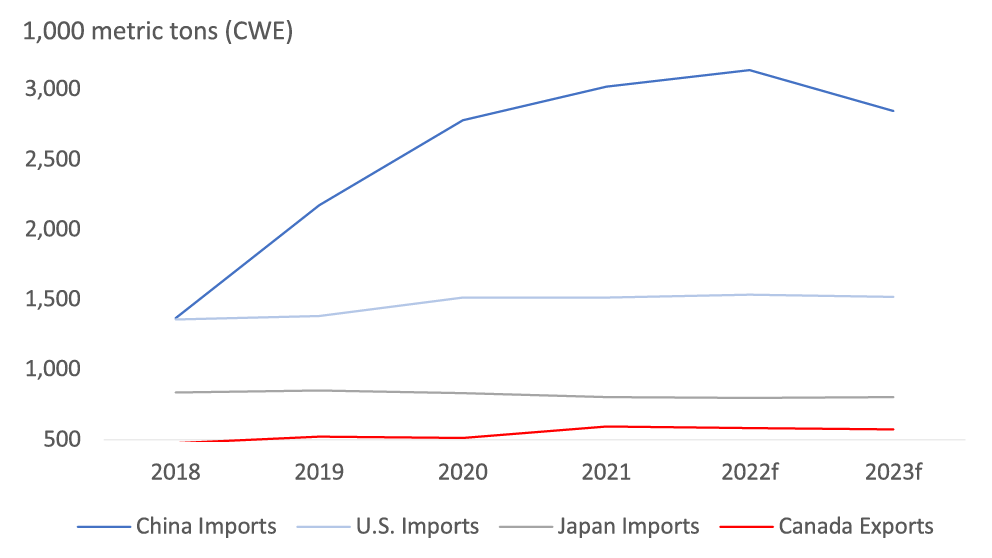

That’s happening in some of the world’s most important red meat markets. According to the IMF, China’s expected growth will falter in 2022, falling from 8.1% in 2021 to 3.2% in 2022. Not surprisingly, the USDA forecasts 2022 Chinese beef consumption to grow a relatively slow 2.6 % YoY, a slowdown from the previous 3-year average of 8.6% annual growth. And after growing their imports 31.8% each year on average between 2018 and 2021, imports are expected to grow 3.8% in 2022 (Figure 1) and to shrink 9.2% in 2023.Figure 1: A meteoric rise in beef imports tapers

Source: USDA Livestock and Poultry World Markets and Trade

China’s recent incredible growth has led to the inevitable shift, but the lack-of-growth trend is also shown in the U.S. and Japan, Canada’s other two largest beef export markets.

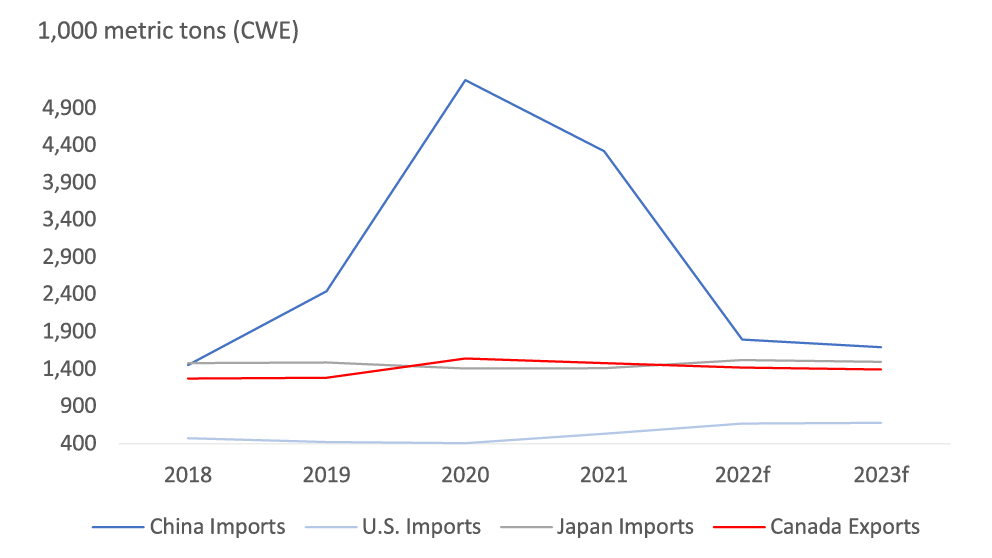

Chinese pork consumption has almost recovered to pre-African Swine Fever (ASF) levels and is on a YoY upswing as their domestic pork production picks up, and more meat becomes available. At the same time, their pork imports have fallen to just above pre-ASF levels (Figure 2).

Figure 2: Chinese pork imports in line with pre-ASF levels

Source: USDA Livestock and Poultry World Markets and Trade

China’s economic slowdown will reverberate throughout Asia, crimping growth and downshifting meat consumption in neighbouring economies.

The war doing nobody any favours

The Russian invasion of Ukraine has created logistical logjams and supply-side commodity volatility, impacting almost every sector of global agriculture. It can be tied directly to the growth in feed costs currently plaguing the North American livestock industries.The war has led to increased global energy and food costs, raising the cost of living to the point of civil unrest and protests. That’s been the case, especially for Europe, where meat consumption is expected to fall, with households reeling from energy costs in what is expected to be a cold winter.

Can domestic demand take up the slack?

With global markets retracting, the North American market remains a brighter spot. The USDA forecasts U.S. per capita beef consumption to rise slightly in 2022 and again in 2023. Their pork consumption also remains high. In Canada, beef consumption was down in the first half of 2022, but expected to be up in the second half. Canadian pork consumption was up 2.8% YoY to start the year and is expected to remain strong.Bottom line

Prices for Canada’s red meat sectors are currently strong and expected to remain elevated throughout the outlook period. But as the world economy continues to decline and export markets respond to weaker conditions, more pressure could be applied to prices. Certainly, Canada’s performance in red meat markets could take a big step backwards, especially from the highs of 2021 – and it may be more a question of “when,” not “if.”... Read MoreSign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.