Agricultural News

The Dirt PodKast: Season 3 - Episode 8: Where Has All the Potassium Gone?

Apr 25, 2024

The Dirt an eKonomics PodKastSeason 3 - Episode 8: Where Has All the Potassium Gone? Tune in with Mike Howell and returning...

Top Six Reasons to Choose Bio-Sul for Your Farming Operation

Apr 25, 2024

Sometimes a decision to save time doesn’t have to cost more. When planning your farm’s crop nutrition plan, choosing Bio-Sul...

The Casual Cattle Conversations Podcast: Applying the Soil Health Principles to Fit Your Operation

Apr 25, 2024

Applying the Soil Health Principles to Fit Your Operation April 22, 2024 | Written By Shaye Koester In Season 7, Episode...

Digital transformation in agriculture retail: Driving efficiency and helping ensure accuracy, every time

Apr 24, 2024

As the agriculture industry continues to evolve, embracing digital solutions for agronomic operations can help retailers...

6 reasons why you need a farm business plan

Apr 24, 2024

A written business plan is an important tool for business success. Think of it as a roadmap—you can travel without one, but...

CCA Budget Reaction: Budget 2024 sends a positive indicator that meaningful changes are coming to Livestock Tax Deferral

Apr 23, 2024

n behalf of beef producers, the Canadian Cattle Association (CCA) is cautiously optimistic that the Government recognized...

Sign up to stay connected

- News

- Property Alerts

- Save your favourite properties

- And more!

Joining Farm Marketer is free, easy and you can opt out at any time.

Featured Properties

$1,675,000

Acreage

19 Acres

Point Prim, PEI

Property Id #: 17522

Indulge in the ultimate opulence waterfront living experience with this exquisite estate offering 19 secluded acres of...

$6,900,000

Cash crop

98.2 Acres

Burford, ON

Property Id #: 17796

Pleased To Present 94 Stage Road, Burford (The "Site"). The Site Offers Farmers With An Excellent Opportunity To Acquire A...

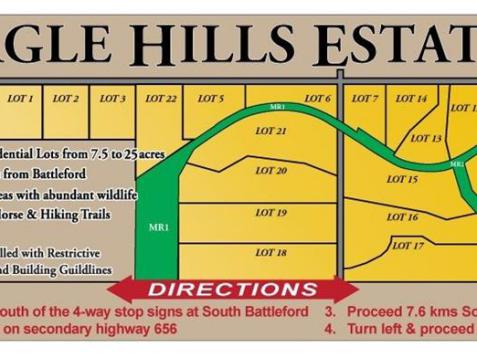

$110,000

Bare land

25 Acres

BattleRiverRmNo438, SK

Property Id #: SK955922

Great acreage to build your dream home or just your own private get-a-way. Here is 24.78 acres in beautiful Eagle Hills...